Quick Search

Categories

- Stevens Institute of Technology

- Pay to Play

- Content Research Area

- Quality of Life Issues

- OPRA (Open Public Records Act)

- Bribes, Payoffs, and Politics

- Letters to the Editor

- Voter Information

- OPMA (Open Public Meetings Act)

- FREE SPEECH and INTERNET ISSUES

- Eminent Domain

- Governor Corzine

- Editorials

- Lawsuits and Legal Actions

- Hoboken News

- Health Issues

- Employment Opportunities

- Regionalize and Shared Services

- Investigations (Restricted Access)

- Government

- Public Official Report Card

- Political Commentary

- Technology

- Payments In Lieu of Taxes

- Consumer Issues

- Affordable Housing

- 2006 N.J. U.S. Senate Race

- U.S. Senator Robert Menendez

- Homeland Security

- NJ NY Port Authority

- R.I.C.O. Act

- NJ.COM

- Editorials - New Jersey Newspapers

- POG - People for OPen Government

- Classifieds

- Politics

- Investigative Agencies

- Hoboken City Council Video

- Presidential Election 2008

- Investigative Report

- Obama

- Area Event Calendar

- Presedential electiom 2008

- New Jersey League of Municipalities

- NJ State Court System

- National Politics

- Social Interaction

- Shrink for Men

- Governor Chris Christie

- Tenant Rights

- NJ League of Municipalities

- ObamaCare

- NYC GROUND ZERO

- Political Figures

- Health Care

- Hoboken Lawsuits

- Featured News

- NYSC

- IRS TAX RELIEF

- Federal Budget

- Healthcare Fraud

- New Jersey For Profit Hospitals

- Hudson County Emergency Medical Services

Hoboken University Medical Center Nurse’s Union JNESO Files Objection in Hudson Healthcare Inc Bankruptcy

- 10-5-2011

- Categorized in: Bribes, Payoffs, and Politics, Featured News, Hoboken Lawsuits, Hoboken University Medical Center HUMC HOLDCO, Municipal Hospital Authority

Hoboken University Medical Center Nurse’s Union JNESO Files Objection in Hudson Healthcare Inc Bankruptcy

October 4, 2011 – By Ed Mecka – http://www.edmecka.com

The union representing nurses at Hoboken University Medical Center filed an objection to the HUDSON HEALTHCARE, INC. bankruptcy plan.

JNESO, District Council 1, IUOE, AFL-CIO (“JNESO”) , the union representing nurses at Hoboken University Medical Center, filed an Objection in U.S. Bankruptcy Court to the two (2) Motions filed by the Debtor, Hudson Healthcare, Inc. (the “Hudson”):

First Omnibus Motion for

(i) Authorization to Sell Substantially All of its Assets Outside the Ordinary Course of Business, Free and Clear of All Liens, Claims, Interests, and Encumbrances, Pursuant to Private Sale;

(ii) Approval of Form and Content of Asset Purchase Agreement Between Hudson and HUMC Holdco, LLC and HUMC Opco, LLC (together, the “Purchaser”);

(iii) Authorization to Assume and Assign Certain of its Executory Contracts and Unexpired Leases;

(iv) Authorization to Sell “Designation Rights” in Connection With Certain Of its Executory Contracts and Unexpired Leases;

(v) Authorization to Reject All Executory Contracts and Unexpired Leases That Are Not Assumed or Designated;

(vi) Authorization to Reject Collective Bargaining Agreements;

(vii) Granting Other Related Relief (the “Sale Motion”); and

Motion of Hudson, Hoboken Municipal Hospital Authority (the “Authority”), The City Of Hoboken (the “City”) and the Hoboken Parking Utility (the “Parking Utility”) for Entry of an Order Approving Settlement and Compromise Pursuant to Fed. R. Bankr. P. 9019 (the “Settlement Motion,” and, collectively with the Sale Motion, the “Motions”).

RECURRENT THEME: “We had NO CONTRACT with the DEBTOR”

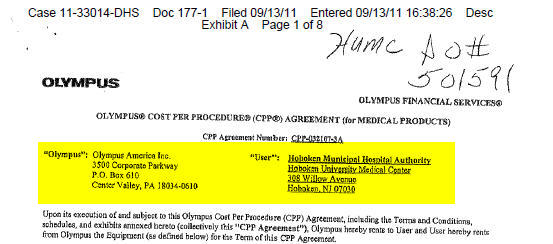

CREDITOR: OLYMPUS AMERICA, INC.

On September 13, 2011 filed a limited OBJECTION to “Debtor’s Motion for Entry of an Order Approving Settlement and Compromise (the “Settlement Motion”). Olympus America, Inc. asserted a valid, binding claim directly against the “Hoboken Municipal Hospital Authority”, a non-debtor, based upon its contract with the Hoboken Municipal Hospital Authority. If the Court agrees, the City of Hoboken may be responsible for payments in excess of $ 372,861.08.

On October 3, 2011, Docket 254, the bankruptcy court ordered;

“Any reference to the Olympus equipment lease shall be deleted from the Debtor's Designated Contracts list and Rejected Contracts list as referenced in Debtor's First Omnibus Motion for Authorization to Sell Substantially all of its Assets (Docket No. 90).”

“Debtor and/ or Purchaser shall pay Olympus the sum of $13,079.69 for September and $13,965.00 for October within five (5) days of entry of this Consent Order. In the event Debtor and/ or Purchaser fails to make a payment as prescribed herein, then Debtor shall make the Equipment available to Olympus and Olympus, in its sole discretion, may take possession of the Equipment without further notice to the Court on October 7, 2011.”

“Nothing contained herein shall prejudice Olympus from pursuing its objection to the Debtor's Motion for Entry of an Order Approving Settlement and Olympus (the "Settlement Motion") (Docket Entry No. 177), or from asserting and pursuing its claim [$ 372,861.08] ("Claim"), if any, against the Hoboken Municipal Hospital Authority ("Authority''), and the Authority shall retain all rights and defenses that it has against the claim or otherwise. In the event an order is entered with regard to the Settlement Motion, that order shall have no bearing or affect on the Claim, and the Authority shall retain all rights and defenses that it has against the Claim or otherwise. Nothing contained herein shall be construed as Olympus's consent to the opening or striking of the judgment entered against the Authority in Lehigh County, Pennsylvania or affect the Authority's right to attempt to open or strike said judgment.”

NOTE: OLYMPUS AMERICA sued the Hospital Authority for $ 372,861.08 in Lehigh County, PA and won a default judgement. The AUTHORITY never responded. Read the case.

U.S. Attorney, District of New Jersey

“On September 20, 2011, The U.S. Attorney, District of New Jersey on behalf of the Secretary of the United States Department of Health and Human Services (“the Secretary”) submitted a Federal Bankruptcy filing to apprise the Purchaser and other interested parties of the consequences surrounding the Purchaser’s acceptance of the Provider Agreement or, alternatively, the Purchaser’s rejection of any such assignment and the Secretary’s opposition to any attempt to transfer the Hospital’s Medicare Provider Agreement without successor liability.”

"Moreover, because the Hoboken Municipal Hospital Authority (and therefore, not the Debtor) is the holder of the Medicare Provider Agreement and is not in bankruptcy, any transaction regarding the transfer of its Provider Agreement with the Secretary must take place outside the scope of this court’s jurisdiction."

JNESO Objection

It is interesting to note that in support of the Objection, JNESO points out that in several instances HUDSON HEALTHCARE INC., Debtor, refers to “Hoboken University Medical Center” as if it were a party to the bankruptcy.

“Hudson’s bankruptcy filing, and the Motions, seek to allow for a sale of the assets of “Hoboken University Medical Center” (the “Hospital”), which is the trade name by which the Authority operates the Hospital, with all of the protections and benefits of 11 U.S.C. § 363, but also seek to allow, among other things, the issuance of shockingly broad releases in favor of numerous third parties, including the City on its guaranty of the Authority’s bond obligations, the Authority, and the Authority and Hudson’s many former and present board members and directors.”

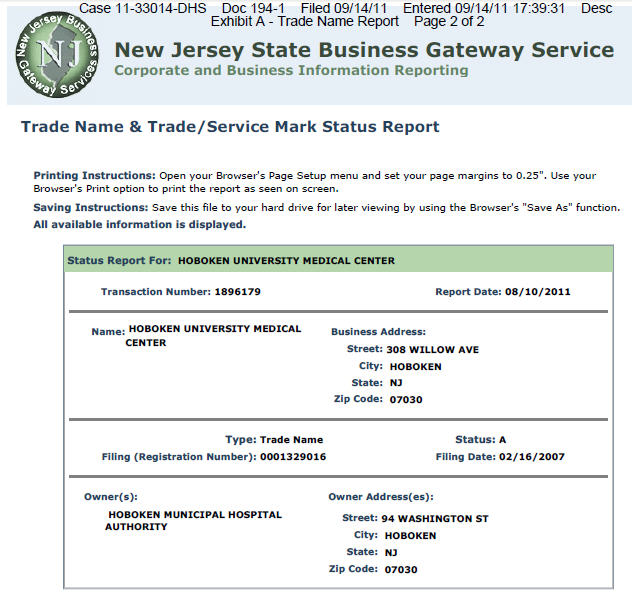

New Jersey State Business Gateway Service "Business Status Report" lists "HOBOKEN UNIVERSITY MEDICAL CENTER" as the registered active "trade name" of the "HOBOKEN MUNICIPAL HOSPITAL AUTHORITY." The Hoboken Municipal Hospital Authority is not in bankruptcy or a Debtor in the HUDSON HEALTHCARE INC. Chapter 11 filing.

“Specifically, as part of these Motions, Hudson [Debtor] requests, among other things, that the Court:

(i) authorize Hudson’s rejection of JNESO’s collective bargaining agreement with the Hospital (As is set forth herein, JNESO’s collective bargaining agreement is not with Hudson, the within debtor) but instead is with the Authority [HOBOKEN MUNICIPAL HOSPITAL AUTHORITY dba/ HOBOKEN UNIVERSITY MEDICAL CENTER, which is not a debtor in this or any other bankruptcy case.

(ii) authorize Hudson’s settlement of its claims against the Authority, based upon the Authority’s withholding of approximately $36 million from Hudson that resulted in Hudson’s inability to pay the Hospital’s obligations, primarily obligations that accrued over the past few months,

(iii) approve the sale of the Authority’s assets, which Hudson does not own, and

(iv) approve releases in favor of the Authority and others from claims of their creditors, and to insulate the Purchaser from all claims.

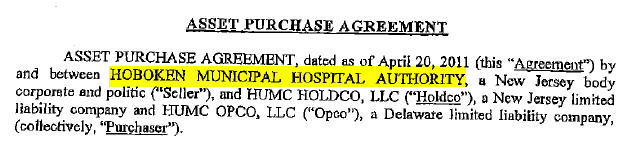

"After the Authority negotiated a sale of substantially all the Hospital’s assets to the Purchaser, and entered in an Asset Purchase Agreement with the Purchaser (the “Authority APA”) on or about April 20, 2011,2 a true copy of which is attached as Exhibit “B,” upon information and belief, the Authority was instrumental both in causing certain members of Hudson’s board of directors to resign, and in replacing them with the Authority’s designees."

WHATS NEXT?:

The BANKRUPTCY court has scheduled a hearing on Thursday, October 6, 2011 at 12:30 pm.

As an observation, based on the OLYMPUS court decision and U.S. Attorney General State of NJ determination that “Hoboken University Hospital” and “Hoboken Municipal Hospital Authority” are not the DEBTOR, it will be interesting to see how the Court rules on the JNESCO objection WHICH CLAIMS THAT THEY DID NOT HAVE AN AGREEMENT WITH THE DEBTOR.

In addition, they have been charges of criminal conduct on the part of the Hoboken Municipal Hospital Authority and HUDSON HEALTHCARE, INC. The attorney was the former legal counsel for HUDSON HEALTHCARE, Inc. who said in Court papers;

"During the period of retention, which ended on July 15,2011, I was a firsthand witness to a pattern of conduct by HMHA members to intimidate, threaten, control, abuse, and attempt to force the CEO of HHI and members of the HHI Board to take actions adverse to its charter and otherwise to violate the laws of the State of New Jersey."

Then there are "SMOKING GUN" emails in which the lawyer for the Hoboken Municipal Hospital Authority (HMHA) discusses a plan with the attorney for HUDSON HEALTHCARE, INC (HHI) for the resignation of THREE members of the HHI members board of directors and replaced by HMHA designees as well as the plan for the HMHA to pick HHI's replacement legal counsel.

The phrase "Redacted for in camera review" leads me to believe that what has become public knowledge of potentially criminal behavior may be the tip of the iceberg.

TABLE OF CONTENTS

COMPLETE JNESO OBJECTION FILING

TABLE OF AUTHORITIES ......................................................................................................... iii

PRELIMINARY STATEMENT .................................................................................................... 1

BACKGROUND ............................................................................................................................ 3

A. Hudson’s Bankruptcy Petition. ..................................................................................... 3

B. Relationship Between Hudson, the Authority and the Hospital. .................................. 4

(i) The Authority’s Obligations Under the Manager Agreement. ............................... 5

(ii) The Authority’s Control and Supervision of Hudson as its Agent. ........................ 7

C. The Authority’s Bond Obligations................................................................................ 8

D. JNESO......................................................................................................................... 10

E. The Collective Bargaining Agreement. ...................................................................... 10

(i) The Interim Agreements. ...................................................................................... 10

(ii) The Hospital’s Failure to Comply with the Interim Agreements the Arbitration....................... 12

F. JNESO’s Claims Against the Hospital. ...................................................................... 13

G. The Proposed Sale of the Hospital.............................................................................. 14

H. The Motions. ............................................................................................................... 16

I. The Continued Hearings/The JNESO Subpoena. ....................................................... 19

OBJECTION................................................................................................................................ 21

I. APPROVAL OF THE AMENDED MOTIONS WILL VIOLATE JNESO’S DUE PROCESS RIGHTS…21

II. HUDSON’S REJECTION OF THE CBA IS VIOLATIVE OF LAW. ........................... 23

A. Hudson Cannot Reject the CBA Because Hudson is not a Party to the CBA. ........... 23

B. Hudson’s Request to Reject the CBA Should be Denied Because Hudson Has

Not Satisfied the Requirements of Section 1113 of the Bankruptcy Code................. 24

(i) General Legal Standards Under Section 1113. ..................................................... 24

(ii) Hudson has Ignored the Procedural Requirements of Section 1113(b). ............... 26

a. Hudson Has Not Satisfied the Threshold Requirements of Section

1113(b)(1). ................................................................................................ 26

b. Hudson Cannot Satisfy the Good Faith Requirement of Section

1113(b)(2) of the Bankruptcy Code. ......................................................... 28

(iii) Hudson Cannot Demonstrate that it Has Complied with Section 1113(c) of

the Bankruptcy Code............................................................................................. 30

C. Hudson’s Unilateral Modifications of the CBA Violate section 1113(f) and Bar Hudson From Rejecting the CBA. .30

D. Alternatively, the Sale Proceeds Should Be Escrowed Pending Resolution of JNESO’s Arbitration. 32

III. THE SETTLEMENT MOTION SHOULD NOT BE APPROVED. ............................... 34

A. Hudson Cannot Carry its Heightened Burden of Establishing that the Proposed Global Settlement is Fair and Equitable and in the Best Interest of Hudson’s Estate............................................. 34

B. The Proposed Releases and Injunctions Should Not Be Approved. ........................... 39

C. The Settlement Cannot Seek Pre-Approval of Terms of a Plan. ................................ 43

CONCLUSION.............................................................................. 44

Email to Friend

Fill in the form below to send this article to a friend:

Recent Blogs

- HAS PREDATORY HEALTH CARE LENDING COME TO HOBOKEN?

- The Emotionally Abusive Personality: Is She a Borderline or a Narcissist?

- Withholding Sex as a Form of Punishment

- Don't Marry Essay. Why Marriage Has Become a Raw Deal for Men

- NJ Business Facts

- What the Parking/Transportation industry is saying about Hoboken's Automated Garage

- You can put lipstick on a pig, but it's still a pig

- Hoboken Board of Education

Recent Employment Opportunities

- Technology Consultant - City of Hoboken

- Finance Director City of Hoboken

- ELECTRICAL INSPECTOR

- Civil Service Commission Seeks Entry-Level Firefighter Applicants Applications for the entry-level Firefighter Test will be accepted for 70 municipalities and other local jurisdictions

- Senior Accountant: Stevens Institute of Technology, Hoboken, NJ

- City of Hoboken - Fire Department Audit

- Hoboken: ZONING OFFICER